A profit and loss statement is an important financial document that summarizes revenue and costs over a specific period. It’s also called a “P&L statement,” “income statement” or “income and expense statement.”

Creating and analyzing a P&L statement can provide valuable insights into the financial health of your business. It can help you monitor profitability, make decisions about future investments and prepare to apply for funding.

A profit and loss statement is an important financial document that tracks a business’s sales and expenses and shows whether or not it was profitable — and by how much — during a specific period. Typically, profit and loss statements are completed monthly.

The profit and loss statement shows important information that, when analyzed alongside balance sheets and cash flow statements, makes business decisions easier. For instance, a P&L statement can help you:

The main purpose of a profit and loss statement is to tell you if your company is making or losing money over a specific period of time, typically monthly, quarterly or annually. You can use profit and loss statements to manage small business finances and make strategic decisions about your business.

In addition to keeping tabs on financial health, a profit and loss statement is needed to secure funding, like business loans and lines of credit. Many lenders, including the Small Business Administration (SBA), require applicants to submit a P&L statement during the loan application process .

There are two accounting methods used for P&L statements: the cash accounting method and the accrual method.

With the cash accounting method, you record sales and expenses when you actually receive or spend money. For example, if you give customers 90 days to pay, you don’t record sales until you receive payment from them. This easy accounting method may be adequate for simple businesses, like food trucks or housekeeping services, that don’t usually have timing differences between when transactions occur and when they are paid for.

Most companies use the accrual method. Under this method you record sales and expenses when the business transaction happens — even if money hasn’t been paid or received yet. Balance sheet accounts like accounts payable and accounts receivable are used to keep track of what you owe and are owed.

The accrual method is necessary for businesses that offer customer financing as well as businesses that keep inventory on hand. It requires use of double-entry accounting software or a bookkeeping service .

Understanding a P&L statement can give you key insights about your business once you understand the metrics it provides. Though these metrics can vary from company to company, they generally include the following:

Net profits are a key metric in your P&L statement: A positive number reflects profit, and a negative number indicates a loss. Losses occur when slow or declining sales are not sufficient to cover operating expenses, or expenses escalate faster than sales. A net loss is a sign of trouble but doesn’t tell the full story. To find out why your business wasn’t profitable, you’ll have to examine individual expense categories. Comparing performance trends over time, like quarter to quarter, may help you pinpoint the areas causing problems.

The first step in creating a P&L statement is to gather your data on sales and expenses. Important information you’ll need to pull together includes:

For revenue:

For expenses:

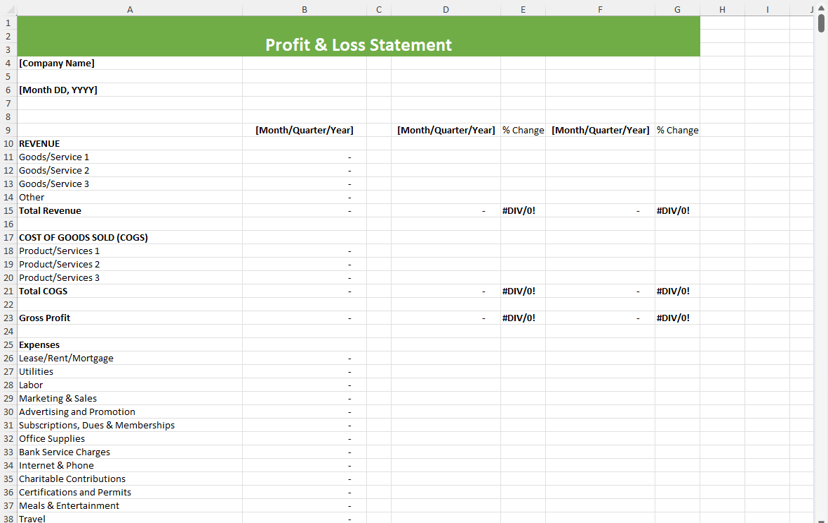

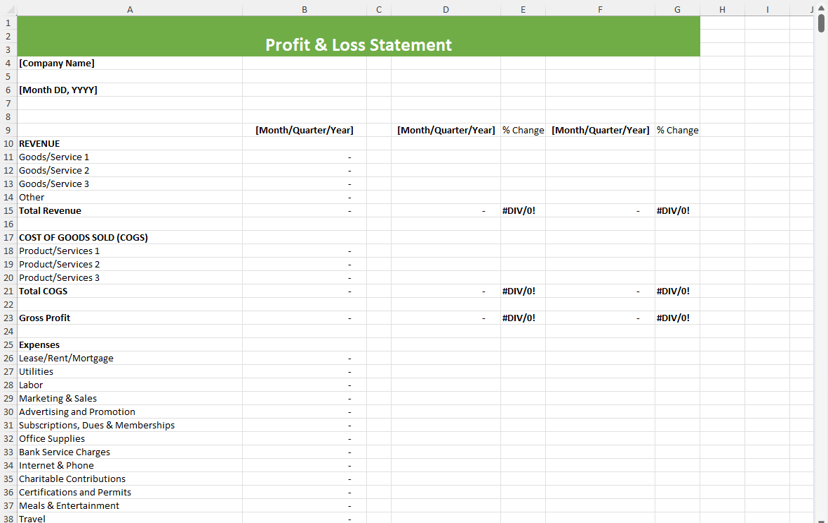

Next it’s time to put your data into a P&L format. You can either purchase accounting software or create your own statement using a spreadsheet program. Using accounting software is generally the most efficient approach because after you input your data, the program automatically generates the P&L statement and other reports.

But if you’re running a very simple business or creating a forecast of future profits based on assumptions, also called a pro forma profit and loss statement, a spreadsheet is the easiest tool for the job. You can build your own P&L spreadsheet template or download a free template.

If you’d like to create your own profit and loss statement on a spreadsheet, these steps will guide you through the process.

You now have a basic P&L statement. You can use it to track profits and losses over time by moving one column to the right (column C, D, E and so on) to input new data each month, quarter or year. You can also incorporate formulas to calculate month-over-month, quarter-over-quarter or year-over-year changes, which can help you spot important trends in your financial situation.

In addition to the P&L statement, other reports that will help you fully understand your business’s health include: